CAREER IN INVESTMENT BANKING

A Career in Investment Banking has got everything when it comes to an interesting career: good income, reputation, strength, anxiety, and fear. However, despite continuous success, a Career in Investment Banking doesn’t necessarily merit experience and hard work. It is a journey full of ups and downs, ups, and downs.

So before you decide to embark on the path of becoming a successful investment banker, first you should find out what Investment Banking is all about.

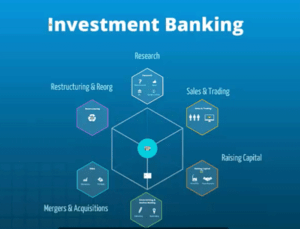

The main function of an Investment Bank is to operate as an intermediary between the companies, which want to raise the money by issuing securities or bonds and individual or institutional investors who can provide money in exchange for securities. Investment bankers handle every aspect of this process. Investment banks profit from charging rates and fees to offer such programs and other forms of financial and market advice. An Investment Bank is a financial institution offering a variety of activities, mainly:

- RAISING CAPITAL SECURITY UNDERWRITING

- MERGERS & ACQUISITIONS

- SALES & TRADING

- RETAIL & COMMERCIAL BANKING

Subscribe our channel for the latest videos:

https://www.youtube.com/VikingsCareerStrategists

CAREER PATH IN INVESTMENT BANKING:

A Career in Investment Banking has got hiccups; however, it is full of opportunities. By showcasing hard work and talent, one can climb up the ladder of various roles in the career path of Investment Banking as given below:

- ANALYST

- ASSOCIATE

- VICE PRESIDENT

- DIRECTOR

- MANAGING DIRECTOR

Suggested subjects in 11th and 12th:

To start with a Career in Investment Banking, subjects related to commerce i.e. Accounts, Economics and Mathematics will be very beneficial for potential Investment Bankers. You have to be good with crunching numbers and analyzing market study & trends, which you can start working on right from class 11th and 12th.

Suggested stream for bachelor’s degree:

Further, to pursue a career in Investment Banking, it is important to strengthen your current knowledge and develop stronger concepts in the domain of finance; you should consider getting a degree in the following:

- CA (Chartered Accountant): They work for various sectors in the economy, managing all the finances of an entity and providing financial advice. You can do this either right after completing your 12th or after completing your graduation. But you must start by writing the ICAI exam. To know more about the exam, visit this website, icai.org.

- Com (Bachelor in Commerce): This makes you learn about debits, credits, the flow of cash and loss and profit margins, total familiarisation of accounting. You can pursue this degree from any of the good colleges, such as SRCC(www.srcc.edu) , LSR(www.lsr.edu.in ), IPU(www.ipu.ac.in) etc.

- BBA (Bachelor in Business Administration): This degree gives sound knowledge of the company’s management with finance as the specialization. You can pursue this degree from any good universities, such as NMIMS(nmims.edu ), Christ University(www.christuniversity.in ), etc.

If you are an Undergraduate, you can directly apply in banks to secure an analyst role in investment banking. If you’re doing well and interested in continuing, and there’s a need, some banks offer direct promotions from analyst to partner rather than asking you to go back and get your MBA done.

Suggested Master’s degree:

MBA (Master in Business Administration) in finance specialization helps in total understanding of the Finances, Investments, and Market Share Portfolios.

In recent days, the demand for business analysts in investment banking is also growing rapidly so Masters in Business Analytics with a finance background in graduation can be a good choice too.

If you are an MBA graduate, you can apply in banks for the purpose of landing into a position of Investment Banking Associate and surely aspire to move up the ranks to Managing Director someday.

Further studies:

A career in Investment Banking doesn’t stop here. To reach a senior position in investment banking early, you can opt for certifications, such as CFA (Chartered Financial Analyst). CFA is highly beneficial for a person pursuing a career in Investment Banking as it is a globally-recognized professional credential in Financial Management & investment offered by CFA Institute. It is also one of the most desirable designations for investment professionals.

Eligibility: So if you wish to go for a CFA certificate, you can apply only after completing your bachelor’s degree and you must have at least 4 years of experience.

If you are eligible for writing this exam, then you can apply for the exam. The CFA exam has three levels: CFA Level 1, CFA Level 2, and CFA Level 3. These exams are conducted in areas related to Economics, Accounting, Security Analysis, and Money Management.

Besides the CFA Exam, the CFA Institute offers two other programs: 1. CIPM (Certificate in Investment Performance Measurement), which has 2 Levels, & 2. Investment Foundations Program. To gain in-depth knowledge about all the programs, visit the website www.cfainstitute.org.

If you pursue any of these programs, you will gain in-depth knowledge of the investment industry which increases their probability of landing into a high paying job in the top companies given below.

Companies hiring Investment Bankers:

A Career in Investment Banking can be very thrilling when you get to work with the top companies such as:

- JP Morgan Chase

- Goldman Sachs

- Citigroup

- HSBC Holdings

- Aditya Birla Capital

Skills Required:

Well, to get into such top companies is no stroke of luck. The role of an Investment Banker obliges some skills in a candidate. You should have the following skills to be a successful Investment Banker:

- Analytical Skills: Employees should have strong analytical, numerical, and spreadsheet skills.

- Team Player: Individuals must possess excellent team leadership and teamwork skills.

- Interpersonal Skills: Candidates should have excellent communication and interpersonal skills.

- Time and Project Management: Investment bankers must be properly able to manage both time and projects well.

- Hard Work: The investment banking role requires a lot of commitment, dedication, and high energy.

- Confidence: The job demands individuals to have self-confidence and an ability to make difficult decisions timely, usually while under a deadline.

Various Domains in Investment Banking:

A Career in Investing Banking is not limited to securities only; it has multiple domains:

Investment Banks are intermediaries between a Company that wants to sell new securities and the public, who wants to purchase those securities. And an Organization hires an Investment Bank anytime it needs to sell, say, new bonds to get funds to redeem an older bond, or to pay for an acquisition or new project. The Investment Bank then calculates the worth and expense of the company with a view of pricing, buying, and then selling the bonds.

The scope of the Merger and Acquisition(M&A) consulting services provided by Investment Banks typically applies to various facets of purchasing and selling businesses and assets, such as company valuation, negotiating, pricing and deal structuring, as well as procedure and execution. When Investment Banks counsel a buyer (acquirer) on a possible purchase, they often also help conduct due diligence to reduce risk and exposure to an acquiring company and concentrate on the true financial identity of the target. Due diligence essentially includes the compilation, review, and evaluation of the financial records of the aim, the study of the historical and expected financial results, etc.

Investment bankers advise the companies which stocks to buy, which stocks to invest in, at what time to invest in which instrument, and at what price they can yield maximum profits. They also take care of the placement of securities with investors which also called underwriting. Underwriting is the process by which an underwriter introduces the investing public a new security concern into an offer. The underwriter guarantees a certain price to the company (client), who issues the protection (in exchange for a fee) for a certain number of securities.

Career preparation for investment banker:

It’s necessary to have a solid understanding of the fundamentals of accounting. First, under your belt, you should do a good Excel crash course, which will show you the fundamentals of shortcuts, formulas, and functions. Then you should progress with financial modeling classes, which will form the base of your day-to-day IB work.

Future of Industry:

A Career in Investment Banking is expected to stay forever. There would always be a need for investment bankers in the market. The advancement in technology is opening up new possibilities to increase the profitability and efficiency of employees as well. With more and more start-ups coming in and increased competition in the market, Investment Bankers will play an important role in yielding better results.

If you think, you are good with crunching numbers, passionate about mastering the complex accounting and finance skills involved in the role, you look forward to becoming an analyst with intentions of having a positive impact on the company, and have the ability to predict the market trends with reasonable assumptions, seeding the idea of becoming an investment banker might be the right career option for you.

We hope this is going to be helpful if you are planning to pursue a career in investment banking. For more guidance, feel free to connect with us and provide your feedback as well, so that we can also improve in the future.